Provisional Income Limits 2025

Provisional Income Limits 2025. If cash transactions are up to 5% of total gross receipts and payments, the threshold limit of turnover for tax audit is increased to rs.10 crores (w.e.f. Provisional income determines the taxation of social security benefits, with specific thresholds for different filing statuses.

Whether opting for taxation under section ? We have updated our tool in line with the income tax changes proposed in the union budget 2023.

If Your Magi Is $77,000 Or Less, You Can Deduct That Full $7,000 From Your Taxable Income On Your 2025 Tax Return (Filed In 2025).

As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the.

We Have Updated Our Tool In Line With The Income Tax Changes Proposed In The Union Budget 2023.

Using these rates means less chance of people getting a.

Provisional Income Limits 2025 Images References :

Source: meldfinancial.com

Source: meldfinancial.com

How to Calculate Provisional (a.k.a. Combined Meld, The table below shows how. Until 1 april 2025, for extra pay calculations use the personal income tax thresholds 1 april 2025 to 30 july 2025.

Source: www.youtube.com

Source: www.youtube.com

How to file Provisional Tax return for Individual and non, Click here to view relevant act & rule. Find out the tds rates.

Source: www.covisum.com

Source: www.covisum.com

Help Clients Calculate Provisional and See How Social Security, Up to half of your social security benefits might be taxable if your provisional income is $25,000 to $34,000 for single filers, or $32,000 to $44,000 for joint filers. Find out the tds rates.

limits San Benito, TX Official Website, If your magi is $77,000 or less, you can deduct that full $7,000 from your taxable income on your 2025 tax return (filed in 2025). Social security benefits are taxed according to your provisional income, which is essentially your modified adjusted gross income, plus nontaxable interest.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, Last updated 12 june 2025. If your magi is $77,000 or less, you can deduct that full $7,000 from your taxable income on your 2025 tax return (filed in 2025).

Source: retiregenz.com

Source: retiregenz.com

What Is Provisional For Social Security Tax Purposes? Retire Gen Z, Find out how to calculate provisional income and what it means to your taxes. Please enter your loan account number, which is.

Source: www.ird.govt.nz

Source: www.ird.govt.nz

How AIM compares to the other provisional tax options, Whether opting for taxation under section ? This is a simple facility of obtaining a certificate of interest for your loan account with us.

Source: whitetaind1989.blogspot.com

Source: whitetaind1989.blogspot.com

White Taind1989, Using these rates means less chance of people getting a. To calculate provisional income, add.

Source: imagetou.com

Source: imagetou.com

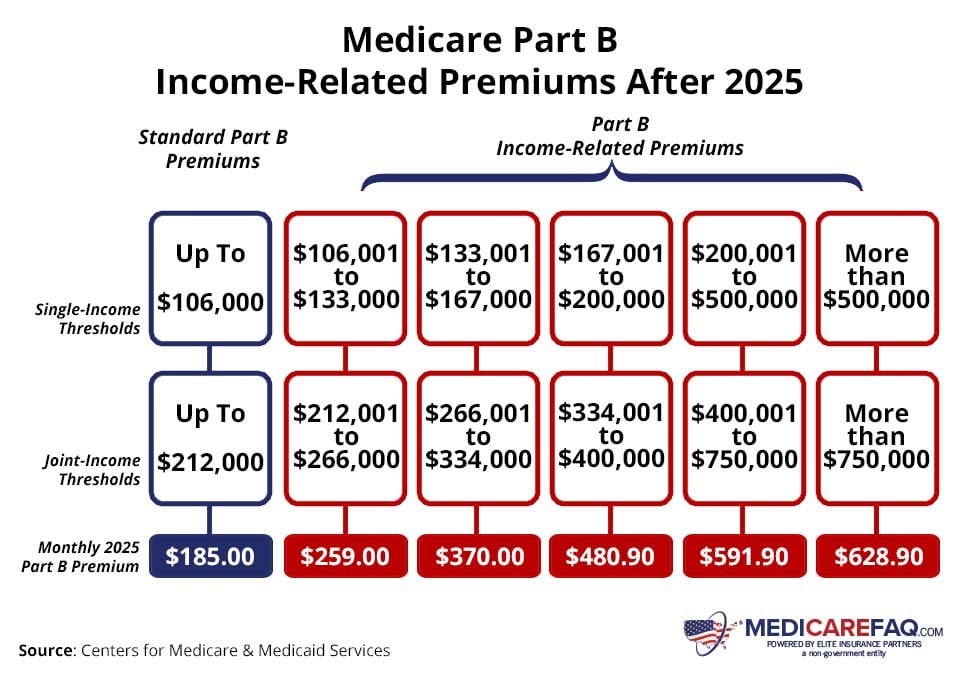

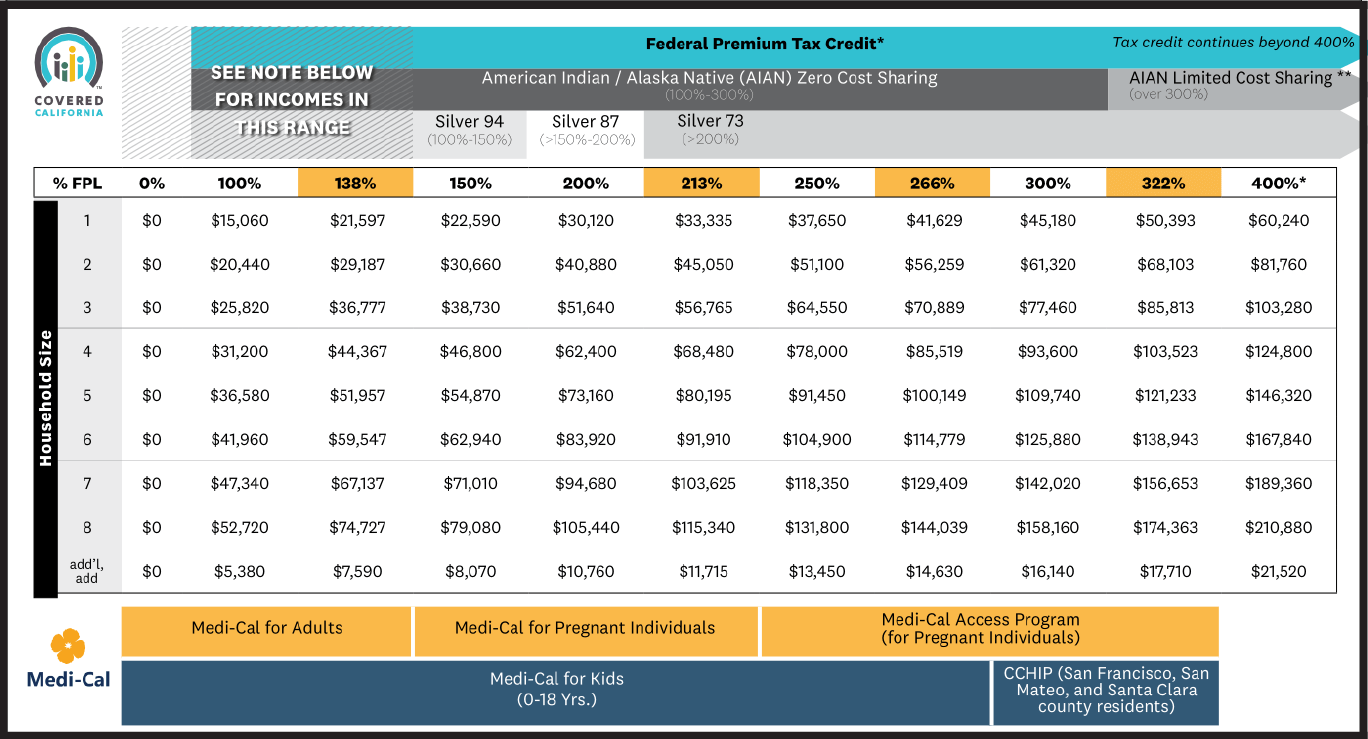

Aptc Limits 2025 Image to u, Provisional income determines the taxation of social security benefits, with specific thresholds for different filing statuses. The table below shows how.

Source: feneliawginni.pages.dev

Source: feneliawginni.pages.dev

Roth Ira Contribution Limits Calendar Year Denys Felisha, Social security benefits are taxed according to your provisional income, which is essentially your modified adjusted gross income, plus nontaxable interest. > personal income from rs 5 lakh to rs 10 lakh is taxed at a rate of 20% in the.

Using These Rates Means Less Chance Of People Getting A.

Last updated 12 june 2025.

Up To Half Of Your Social Security Benefits Might Be Taxable If Your Provisional Income Is $25,000 To $34,000 For Single Filers, Or $32,000 To $44,000 For Joint Filers.

Tax deduction at source (tds) is one of the important compliances of income tax.

Category: 2025